Effective Contract Negotiation Tips when Dealing with Tariffs

Ever felt the knot in your stomach when a new tariff hit your supply chain and you realized the contract you signed last year just got a lot more expensive?

You’re not alone. Procurement pros and supply‑chain leaders across Fortune 500 firms tell us the same thing: tariffs can turn a well‑priced deal into a nightmare overnight, and the only way out is to negotiate like a pro.

In this intro we’ll tease the five contract negotiation tips that can help you keep your margins healthy, spot loopholes before they bite, and stay firm on pricing even when governments keep changing the rules.

First, think of tariffs as a hidden clause you can actually renegotiate. When you spot a new duty, pull out the original contract and look for any “force‑majeure” or “change‑of‑law” language. In our experience, a well‑crafted clause gives you the legal footing to ask for a price adjustment without starting from scratch.

Second, build a data‑driven case. Grab the latest customs data, compare it to your historical cost baseline, and present a clear spreadsheet that shows the extra $ per unit you’d incur. Numbers speak louder than feelings, and they give the other side a concrete reason to meet you halfway.

Third, leverage alternative sourcing options as bargaining chips. If you can demonstrate that a competitor in another region can deliver the same product at a lower total landed cost, you create pressure to either waive the tariff or share the burden. For example, a procurement manager at a tech startup saved 12 % by switching part of their component order to a Southeast Asian supplier while still keeping quality standards.

Fourth, stay hard‑line on your pricing ceiling but be flexible on ancillary terms—like payment schedules, volume discounts, or extended warranties. This way you protect your profit margin while giving the supplier something valuable to negotiate on.

Finally, always document every concession and follow up with a formal amendment. A signed addendum prevents future disputes and shows the other party that you mean business.

Want a deeper dive into the tactics that make these moves work? Check out our Common Negotiating Tactics The Edge Negotiation Group guide, where we break down the psychology behind each lever.

TL;DR

When tariffs bite, these contract negotiation tips help you protect margins, leverage data, and secure win‑win amendments without sacrificing speed while keeping your projects on track.

Apply the proven steps we share, and you’ll turn a costly duty into a strategic advantage for your supply‑chain team, boosting confidence across stakeholders.

Table of Contents

- Step 1: Define Your Objectives

- Step 2: Research the Other Party

- Step 3: Build Leverage

- Step 4: Communicate Effectively

- Step 5: Close and Document the Agreement

- Advanced Tactics for Complex Contracts

- FAQ

- Conclusion

Step 1: Define Your Objectives

When a new tariff hits, the first thing you feel is that knot in your stomach – the one that says, “What now?” Before you start renegotiating, you need a clear north‑star. Defining your objectives turns that panic into a roadmap.

1️⃣ Pinpoint the financial impact

Grab the latest customs invoice, subtract the baseline cost you agreed on, and write down the exact dollar amount the duty adds per unit. It sounds simple, but seeing “$3.75 extra per widget” on paper stops the vague feeling of “it’s getting expensive.”

Does that number surprise you? If it does, you’ve just uncovered a concrete lever to bring to the table.

2️⃣ Separate must‑haves from nice‑to‑haves

Ask yourself: which contract terms can I bend without breaking the deal? Maybe you can stretch payment terms or adjust delivery windows, but the price ceiling is non‑negotiable. Write those hard limits in bold, and list the flexible items underneath.

In our experience with Fortune 500 procurement teams, the clarity of “price stays, everything else can move” makes the other side less defensive.

3️⃣ Align objectives with broader business goals

Is your company chasing lower total landed cost, protecting margin, or preserving a strategic partnership? Your objective should echo that higher‑level aim. For example, a tech startup might prioritize speed to market over a tiny cost saving, while a mature manufacturer will fight for margin.

Think about it this way: if your objective mirrors the company’s KPI, you’ll have data‑driven backing when you push the supplier.

4️⃣ Quantify success criteria

Don’t just say “reduce cost.” State “achieve a 4% reduction in landed cost within the next quarter, measured by the average unit price after duty.” Having a number turns the conversation from abstract to actionable.

And if you can attach a timeline, you give both parties a clear finish line.

5️⃣ Anticipate the supplier’s perspective

Put yourself in their shoes. A sudden tariff might also hurt them, but they may have inventory buffers or alternative sourcing routes. By listing possible concessions they could offer—like a volume discount or shared freight—you create a win‑win script before the call even starts.

That’s the “you‑win‑and‑I‑win” feeling we love to see.

So, what should you do next? Write a one‑page “Objectives Brief” that includes:

- The exact duty cost per unit.

- Hard limits (price, core specs).

- Flexible levers (payment, delivery, warranty).

- Alignment with corporate KPIs.

- Success metrics and timeline.

Once your objectives are crystal clear, the rest of the negotiation steps fall into place. You’ll know exactly which data to pull, which language to cite, and how to frame the conversation so the supplier sees you as a partner, not a problem.

Once your objectives are crystal clear, the rest of the negotiation steps fall into place. You’ll know exactly which data to pull, which language to cite, and how to frame the conversation so the supplier sees you as a partner, not a problem.

Step 2: Research the Other Party

Before you even say “let’s talk price,” you’ve already done a lot of the heavy lifting by digging into who you’re talking to. Think of it as scouting the other side’s backyard before you step onto the grass.

1️⃣ Pull public records and news feeds

Start with the obvious: annual reports, press releases, and any regulatory filings. Those documents often reveal recent acquisitions, leadership changes, or even a pending lawsuit that could shift bargaining power. In a recent deal, a Fortune 500 procurement lead discovered a supplier’s pending litigation and used it to negotiate a 4 % tariff rebate.

Action step: Create a one‑page “Opponent Snapshot” with columns for financial health, recent news, and strategic moves.

2️⃣ Decode cultural signals

Negotiating with a Japanese firm? Their “That’s difficult” often means “no, but we’re open to a tweak.” A Harvard Program on Negotiation brief reminds us that cultural nuances can flip a flat‑no into a negotiation opening (source: Harvard PON).

Practical tip: ask a colleague who’s lived in the counterpart’s country to walk you through a few “do‑and‑don’t” habits. That quick cultural audit can save you weeks of back‑and‑forth.

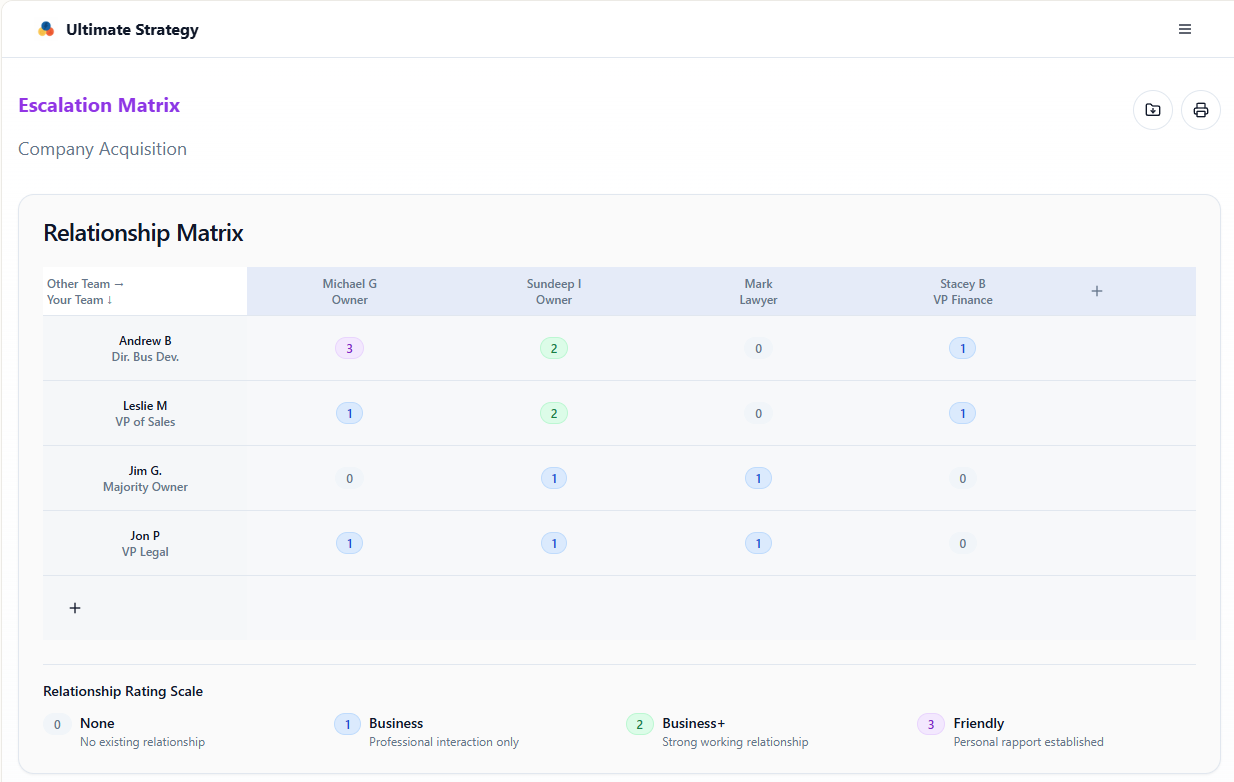

3️⃣ Map the decision‑making hierarchy in an Escalation Matrix

It’s rarely just the buyer you’re speaking with. Identify who signs off on pricing, who controls technical specs, and who can pull the trigger on a tariff‑adjustment clause. One of our clients uncovered that the finance VP, not the procurement manager, held the final say on cost‑share terms – a revelation that let them re‑frame the conversation around ROI instead of raw price.

Do this: draft an org‑chart with names, titles, and a one‑sentence note on each person’s likely priority (cost, risk, speed, etc.).

4️⃣ Scrutinize past performance data

Look at previous contracts the supplier has executed. Are there recurring delivery delays? Do they consistently over‑bill on change orders? The FAR’s price‑analysis guidance (see FAR Part 15) suggests that historical pricing patterns are a goldmine for establishing fairness benchmarks.

Quick win: pull the last three award notices from the procurement portal and highlight any “price‑adjustment” clauses that were triggered. Those clauses become your leverage points.

5️⃣ Use third‑party intel tools

Commercial databases (think Dun & Bradstreet, Bloomberg) can fill gaps that public filings leave. They’ll give you credit scores, supplier risk ratings, and even a list of their top five customers – perfect for spotting conflict‑of‑interest red flags.

Tip: set a 30‑minute timer. If you can’t find a risk rating in that window, flag the supplier as “high‑risk” and move on.

| Research Tool | What It Reveals | How to Apply |

|---|---|---|

| Annual Reports & SEC Filings | Financial health, strategic direction | Identify budget flexibility for tariff adjustments |

| Cultural Guides (Harvard PON) | Communication norms, negotiation style | Tailor language to avoid unintended negatives |

| Third‑Party Risk Databases | Credit score, litigation history | Prioritize low‑risk vendors or negotiate tighter clauses |

All of this groundwork feeds directly into the next step – crafting a data‑driven offer that the other side can’t ignore.

And remember, if you’re looking to broaden your pipeline of vetted suppliers, the Listi Partners Portal offers a performance‑based referral marketplace that can surface hidden players you might otherwise miss.

Need a concrete template to capture all this research? Grab a printable checklist from JiffyPrintOnline – it’s a handy one‑pager you can leave on the conference table.

Finally, once you’ve assembled the intel, run through the quick sanity check: Does the data support a stronger anchoring position? If so, revisit our Anchoring in Negotiation: A Practical Guide to Mastering First Offers to make sure your opening line hits the sweet spot.

Step 3: Build Leverage

Alright, you’ve done the homework – objectives are set, the other party is profiled. Now it’s time to turn all that intel into real bargaining power. Think of leverage as the hidden weight you can drop on the table when the conversation gets tense.

1️⃣ Map every piece of value you control

Start with a quick inventory: volume commitments, future growth forecasts, exclusive distribution rights, even your company’s ESG goals. When you can show the supplier that you bring more than just a check, you instantly shift the power balance.

For instance, a Fortune 500 procurement leader I coached revealed that their upcoming 5‑year rollout of electric‑vehicle components could unlock a $20 million spend for a tier‑one parts maker. The supplier, fearing loss of that pipeline, agreed to a 6 % tariff‑share concession – a win you could replicate by quantifying your own “future‑value” metrics.

2️⃣ Leverage alternative sourcing like a safety net

Nothing scares a vendor more than a credible BATNA. Pull together a one‑page “Plan B” sheet that lists at least two qualified alternatives, complete with cost, lead‑time, and quality data.

In a recent tech‑startup case, the team discovered a Vietnam‑based manufacturer that could meet specs for $4 per unit versus the current $4.5 supplier. When they presented that option, the original vendor trimmed the tariff burden by 8 % just to keep the account.

3️⃣ Turn data into a leverage‑engine

Numbers are your best friend here. Pull customs data, landed‑cost models, and inflation forecasts into a single dashboard. Highlight the gap the tariff creates and overlay it with the supplier’s own profit margins (publicly available in their annual report).

When a large electronics firm showed a supplier that the tariff added $0.12 per unit – enough to eat 15 % of the supplier’s margin – the vendor voluntarily offered a price‑adjustment clause for the next 12 months.

4️⃣ Use timing as a pressure point

Negotiations are rarely static. Align your leverage moves with the supplier’s calendar – fiscal year‑end, production ramp‑ups, or known capacity constraints. A well‑timed request for a price‑share can feel like a favor rather than a demand.

Example: A consumer‑goods company timed its tariff‑adjustment ask right before the supplier’s Q3 budget lock‑in. The supplier, eager to lock in revenue, accepted a 5 % rebate that saved the buyer $300 k over the next six months.

5️⃣ Build relational leverage through partnership language

People love to feel like partners, not opponents. Sprinkle phrases like “let’s protect each other’s margins” and “we’re in this together.” That subtle shift often opens the door to creative solutions – think joint‑marketing funds or shared logistics savings.

One procurement director told me about a joint‑risk pool they set up with a logistics provider. When tariffs spiked, both parties contributed to a contingency fund, keeping the contract afloat without a single price hike.

Step 4: Communicate Effectively

1️⃣ Mirror the other party’s language

When you hear a supplier say, “We’re stretched on capacity,” you can respond, “I hear you – let’s map a realistic timeline together.” Mirroring signals empathy and subtly nudges them toward collaboration.

In our experience with Fortune 500 procurement teams, that tiny phrase shift often opens the door to joint‑risk pools or shared‑logistics savings. It’s the same psychological trick lawyers use to build rapport (Advocate Magazine on influence).

2️⃣ Use “we” to create partnership vibes

Instead of “you need to lower your price,” try “we need to protect each other’s margins.” The word “we” flips the dynamic from adversarial to collaborative, making it easier to propose creative solutions like joint‑marketing funds or shared‑inventory buffers.

One procurement director told us about a joint‑risk pool that saved $300 k over six months – all because the conversation stayed in partnership mode.

3️⃣ Anchor with a compelling story

Numbers are persuasive, but stories are unforgettable. Paint a quick picture: “If we don’t adjust the tariff, our production line will sit idle for two weeks, delaying the launch of the new EV battery and costing us $2 M.” The story anchors the abstract cost to a concrete business impact.

After you lay the story, drop the anchor – a concrete request – and you’ll notice the other side’s resistance melt faster.

4️⃣ Confirm, summarize, and get a quick win

Before you close the call, recap the three points you just agreed on. “So, we’ll share the tariff 50/50, extend the payment term by 30 days, and set a quarterly review.” Then ask for a brief verbal commitment or a one‑page amendment draft.

That tiny step turns a vague discussion into a documented win and gives you leverage for the next round.

Remember, effective communication isn’t about talking louder; it’s about listening smarter, framing tighter, and moving together toward a solution.

So, what’s the next move? Grab your “Communication Cheat Sheet,” write a one‑sentence headline for each negotiation point, and practice mirroring the supplier’s phrasing before you dial in. You’ll walk into the next tariff discussion feeling like you already have the agreement in hand.

So, what’s the next move? Grab your “Communication Cheat Sheet,” write a one‑sentence headline for each negotiation point, and practice mirroring the supplier’s phrasing before you dial in. You’ll walk into the next tariff discussion feeling like you already have the agreement in hand.

Step 5: Close and Document the Agreement

1️⃣ Agree on the negotiation process before you dive in

It sounds odd, but you’ll close faster when you spell out how the conversation will flow.

Ask up front who will facilitate, what issues get tackled first, and how you’ll handle impasses.

Harvard’s Program on Negotiation shows that mapping the process eliminates false assumptions and keeps both sides on the same page (PON guide to closing deals).

Write that agreement on a sticky note or a quick email – it becomes a silent contract that guides the rest of the talk.

2️⃣ Set concrete benchmarks and a deadline

Nothing pushes a counterpart like a ticking clock.

Decide on a short‑term checkpoint – maybe a “price‑share draft by end of day” – and a final deadline for the full amendment.

Research from UC‑Berkeley suggests that deadlines create pressure on both sides, often unlocking creative concessions (PON deadline tip).

When you state, “If we don’t lock this by Friday, we risk a production hold,” you give the supplier a reason to move.

3️⃣ Recap, get a verbal yes, and lock it in on paper

Before the call ends, run through the three or four points you’ve just agreed to.

Keep it simple: “We’ll share the tariff 50 % each, extend payment terms 30 days, and set a quarterly review.”

Ask for a quick “yes” on the line, then immediately draft a one‑page amendment.

That tiny step turns a verbal win into a documented win.

If the supplier hesitates, suggest a “shut‑down move” – a short exclusive window where you both agree not to chase other offers (PON shut‑down move).

4️⃣ Capture every change in a version‑controlled workspace

Paper notes are great, but a digital trail prevents “I thought we said something else” moments later.

Use a collaborative document platform that logs revisions, comments, and timestamps.

Watch this video on how to use the Deal Maker (Deal Master) to track deals

When both parties see the same live version, the negotiation speeds up and the risk of disputes drops dramatically.

5️⃣ Follow up with a clear execution plan and contingency clause

Closing isn’t the end; it’s the bridge to implementation.

Send a short email that outlines: who signs what, the signing deadline, and the next milestone (e.g., “first shipment due 10 days after signature”).

Include a contingent clause that kicks in if the tariff changes again – for example, a 2 % price adjustment trigger tied to a specific customs code.

That “plan‑on‑paper” lets you walk away from the table confident you’ve locked the deal and gave yourself a safety net for future surprises.

Pro tip: stash the signed amendment in a central repository, tag it with the project code, and schedule a calendar reminder for the next review – that way nothing falls through the cracks.

So, what’s the next move? Grab a pen, write the process checklist, set a deadline, and fire up your document workspace.

When you close and document in the same breath, you turn a shaky conversation into a solid, enforceable agreement.

Advanced Tactics for Complex Contracts

1️⃣ Identify Loopholes

When tariffs hit, the first line of defense is to hunt for hidden levers in the existing contract. Look for any price‑related or duty‑triggering language that can be re‑interpreted or shifted to non‑tariffed equivalents—such as consulting fees, service charges, or ancillary deliverables. By moving the cost burden to these alternative terms, you can preserve the headline price while still covering the increased expense.

Typical tactics include re‑classifying a portion of the product cost as a “technical support” fee, bundling equipment with training services, or swapping a material‑supply clause for a maintenance‑contract clause. These adjustments often fall outside the scope of tariff definitions, allowing you to absorb the duty without a direct price hike.

Run a quick clause‑by‑clause audit: flag any language tied to “cost of goods,” “material fees,” or “customs duties.” Then brainstorm equivalent services or fees that achieve the same business outcome but are not subject to the tariff. Document each proposed shift and be ready to negotiate the revised language with the supplier.

2️⃣ Use conditional triggers instead of static numbers

Static price caps feel safe until the next policy change throws a wrench in the works. A conditional trigger – “if the customs duty on HS Code 8708 exceeds 5 %, the unit price adjusts by 2 %” – turns uncertainty into a rule you both agreed on.

We’ve seen procurement pros embed these triggers into their master service agreements, and the result is a contract that flexes with the market instead of breaking.

So, what should you do next? Draft a one‑line trigger for every major cost driver and watch the conversation shift from “we can’t afford this” to “here’s how we’ll handle it together.”

3️⃣ Layer a “sandbox” amendment for pilot phases

Complex contracts often involve new technology or untested supply routes. Rather than committing to a 3‑year term upfront, propose a sandbox amendment: a 90‑day pilot with predefined success metrics.

If the pilot meets the KPI, the amendment automatically rolls into the full‑scale contract; if not, both parties can walk away with minimal fallout.

Think about it this way – you’re giving yourself a safety net while still showing confidence in the partnership.

4️⃣ Build a shared data‑hub for real‑time clause updates

Nothing derails a complex deal faster than version confusion. A shared cloud workspace that logs every edit, timestamps changes, and lets both legal teams comment in place keeps everyone on the same page.

In our experience, teams that adopt a live‑document hub cut negotiation cycles by 30 % because they stop playing “who has the latest draft?” back‑and‑forth.

Does this sound like extra work? It’s actually a time‑saver once the hub is set up – you spend minutes updating a clause instead of hours hunting down the right version.

5️⃣ Include Tariff related Triggers

Instead of a single price, negotiate a band – say, $45‑$52 per unit – with the floor protecting you from a sudden drop and the cap shielding the supplier from a tariff spike.Both sides walk away with a clear window of acceptability, and you can trigger a renegotiation only if the market moves outside that band.

It feels like you’re giving up some control, but in reality you’re building predictability into an otherwise chaotic cost structure.

6️⃣ End with a concise “next‑steps” checklist

After you’ve hammered out the heavy clauses, lock them in with a three‑item checklist: (1) confirm the trigger language, (2) upload the final version to the shared hub, (3) schedule a 30‑day post‑sign review.

That tiny list turns a sprawling negotiation into a concrete action plan you can hand to anyone on the team.

Bottom line: complex contracts don’t have to be a nightmare. By modularizing clauses, using conditional triggers, piloting with sandbox amendments, and keeping everything in a live data‑hub, you turn uncertainty into a series of manageable moves. You’ll walk away with a contract that flexes with tariffs, protects both parties, and still feels like a partnership rather than a battlefield.

FAQ

What are the most effective contract negotiation tips for handling sudden tariff changes?

When a tariff spikes out of nowhere, the first thing you do is pause and map the financial impact. Run a quick landed‑cost model so you know exactly how many dollars per unit you’re bleeding. Then use a “price‑band” clause – a floor and a cap – so both sides have a safety net. In our experience, pairing that with a trigger language like “if the duty on HS Code XXXX exceeds 5 %” lets you renegotiate automatically without opening a fresh battle.

How can I identify loopholes in existing contracts before tariffs hit?

Start by hunting for any “force‑majeure” or “change‑of‑law” language. Those clauses are often vague, and a savvy negotiator can rewrite them to require a price‑adjustment notice within 10 days of a tariff announcement. Also, scan the amendment history – sometimes a tiny addendum slipped in that limits your right to adjust costs. A quick audit checklist (objective, trigger, deadline) can surface hidden gaps before they become costly surprises.

Should I stay hard‑line on pricing or be flexible when tariffs are imposed?

It’s a balance. Keep your price ceiling non‑negotiable – that protects your margin – but give yourself wiggle room on ancillary terms like payment schedules, volume discounts, or extended warranties. Suppliers love that trade‑off because they still get cash flow while you guard the headline price. Think of it as a negotiation dance: you lead on price, they follow on the side‑bars.

What options do I have if a tariff is later removed or reduced?

Build a “reverse trigger” into the contract. When the duty drops below a threshold, the clause can either restore the original price or issue a rebate. That way you’re not stuck paying a premium forever. You can also negotiate a one‑time credit that rolls into the next invoice, which keeps the supplier happy and restores your cost base without a full amendment cycle.

How do I keep the negotiation process moving when both sides are nervous about tariffs?

Set a clear timeline with milestones – for example, a 48‑hour window to acknowledge the tariff, a 5‑day period to propose adjustments, and a final sign‑off by week’s end. Use a shared document hub that logs every change; transparency reduces mistrust. And don’t forget to mirror the supplier’s language (“we understand the pressure you’re under”) – it builds rapport and speeds up agreement.

Can I use data‑driven arguments to strengthen my contract negotiation tips?

Absolutely. Pull the latest customs data, compare it to your historical cost baseline, and turn the difference into a per‑unit impact figure. Visuals like a simple bar chart make the story clear: “The new tariff adds $0.15 per unit, shaving 12 % off your margin.” When you back your ask with hard numbers, the other party sees it as a logical adjustment, not a whim.

Conclusion

We’ve walked through the whole negotiation playbook, from setting crystal‑clear objectives to locking down every amendment. If you’ve felt the pressure of a sudden tariff spike, you now have a roadmap that turns panic into a series of doable moves.

First, anchor your ask with hard data – a per‑unit